Private equity deal activity is on pace for its best year on record. With $457 billion worth of deal activity recorded over the first half of the year, according to data from PitchBook, the cumulative activity midway through the year is the strongest it has ever been in terms of both deal value and deal count. Deal activity in the middle market (typically deals valued between $25 million and $500 million) leads the way, making up over 62% of the deal volume by both measures—the highest proportion ever recorded.

A resurgent U.S. economy in the first half of the year and forecasts for strong growth in the back half sustained the momentum that started in the fourth quarter of 2019. Deal-making sentiment was bolstered by growing confidence as more people got vaccinated, and financial conditions remained largely accommodative, with the Federal Reserve keeping liquidity plentiful and interest rates low.

“The Olympic magnitude of deal flow is on track to set new records in 2021 based on the relentless demand we are seeing from our clients for M&A advisory services,” says Joe Ring, national mergers and acquisitions integration and separation practice lead at RSM. “The current deal pace requires careful planning and execution to realize the deal thesis outcomes.”

Incentives to pursue deals also remained elevated on both sides, with ample private equity dry powder encouraging buyers to seek avenues to deploy capital and business owners motivated to sell due to the possibility of capital gains taxes being raised as the Biden administration seeks to fulfill its agenda.

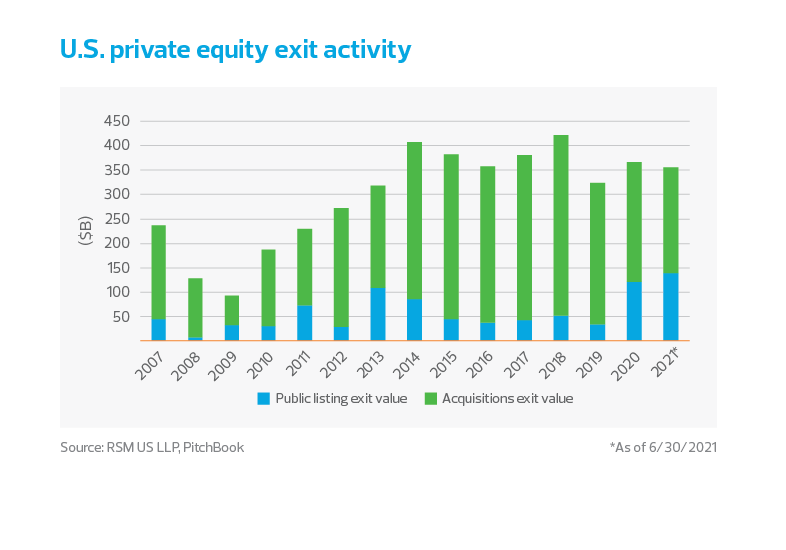

Exits

Exit activity ran even hotter than overall deals, driven by the most active half-year of initial public offerings on record. As of the end of June, exits in 2021 nearly matched the total for all of 2020 and already exceeded the full-year total for 2019. Cumulative exit activity at the end of June totaled $356 billion compared to the annual total of $367 billion and $323 billion for 2020 and 2019, respectively, according to PitchBook data.

With stock market valuations soaring, exits via public listing have been on a tear and were the main driver behind the explosion in exit transactions in the first half of the year. Activity has already generated a record total in dollar terms for private equity exits via initial public offering, with another six months still to be recorded. Approximately $140 billion in IPO activity was recorded by the end of June, contributing 39% of the total private equity exits over this period. These are staggering numbers coming on the back of the annual IPO exits total of $122 billion from 2020, which in itself set a new record.

A total of 60 IPOs of private equity-backed portfolio companies came to market through the end of June, representing approximately 9% of the total count, compared to an average of only 5% prior to this year, according to PitchBook data going back to 2007.

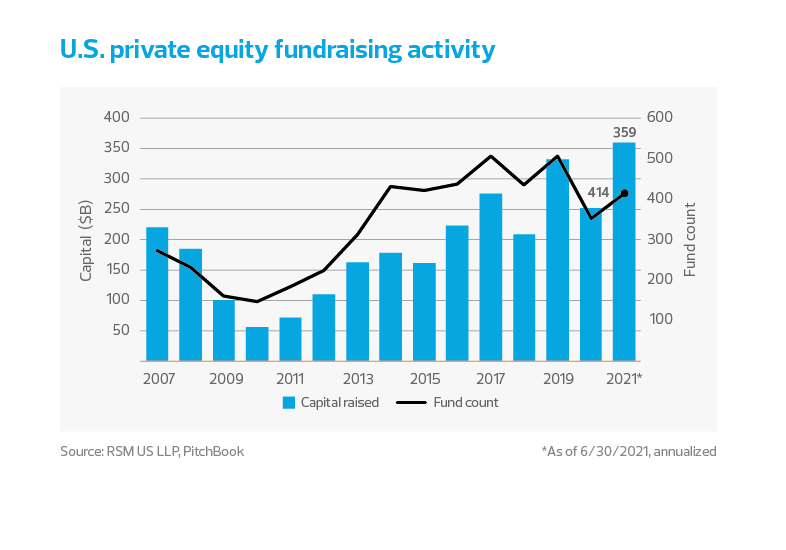

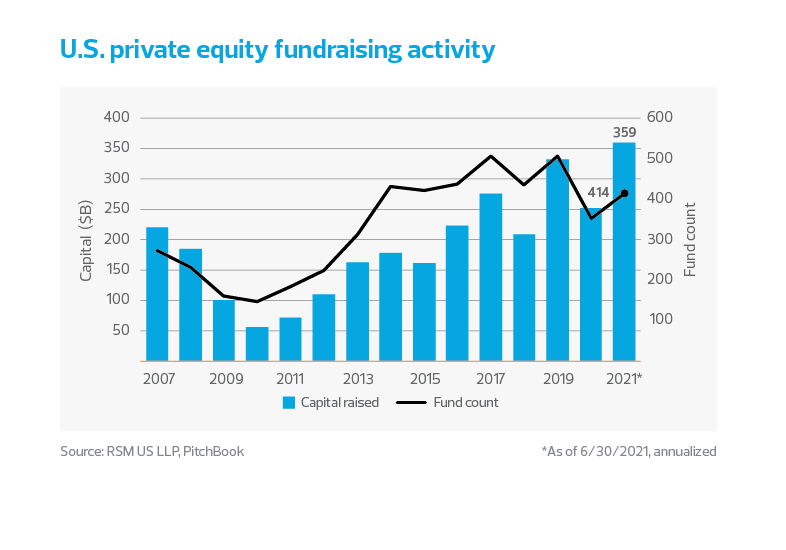

Fundraising

While fundraising is healthy and might break records for capital raised, it is not on track to beat fund count records. As of June 30, $180 billon of capital was raised across 207 funds, per PitchBook. Annualizing this data translates to a potential $359 billion of capital raised in 2021, which would be slightly better than the previous record of $332 billion raised in 2019. Annualizing the fund count translates to 414 funds for 2021, which would be higher than 2020 but not compared to 2019.

The pickup in fundraising in 2021 reflects the move away from the “putting out fires” mentality brought on by the pandemic toward more stability this year, with firms better able to revert to fundraising. When looking at PitchBook data for the total dry powder available at the end of the second quarter, U.S. private equity firms likely have $1 trillion in capital available to deploy.

Outlook for second half of the year

Based on July data from Bloomberg, it appears that this breakneck pace in private equity deal activity, exits and fundraising may persist through the end of the year.

A key factor that points to continued strength in deal-making is the fact that fund managers have learned to conduct deals and some aspects of the due diligence process virtually. One benefit of virtual deal activity is that U.S. funds have increased their investment in portfolio companies outside the country. Another factor that will continue to support deal activity is that the U.S. economy has largely opened up, resulting in more in-person meetings. While knowing how to conduct a deal virtually is helpful, having the option of holding more in-person meetings will be beneficial in the long term.

Additionally, private equity as an asset class continues to be in high demand. Accordingly, Private Equity International’s December 2020 LP Perspectives Study showed that 80% of limited partners were confident the asset class would continue to perform in 2021. About 40% of the limited partners surveyed indicated they were under allocated in private equity and planned to increase or maintain their commitments. This, coupled with strong exit activity, indicates the second half of 2021 will be as hot as the first. While tailwinds are expected to continue stimulating private equity activity for the second half of the year, some downside risks could still arise.

After plummeting from peak levels in January, new reported COVID-19 cases and related hospitalizations and deaths have been rising again in the United States since early July. The spread of the delta variant of the virus has led some companies to push back return-to-office timelines and reinstate mask-wearing guidance. If the curve continues its upward trend and more restrictive measures are implemented to minimize the damage, there is a risk that economic activity and business sentiment will drop to levels that may lead to a slowdown in private equity activity.

Financial conditions have been very accommodative, with strong support from the Federal Reserve. A shift in conditions for the worse might put a damper on the frenetic pace of private equity deal activity and capital raising. While the risk currently seems low, this is worth watching, as it can change should markets look to test the Fed’s resolve and patience in normalizing monetary policy from the current ultraloose stance.

This happened in the first half of the year when fears that inflation might overrun benchmark interest rates led to a rise in market yields and a spike in stock market volatility, briefly sending financial conditions on a downward trend before the Fed regained the narrative. Fears of policy error as the Fed starts contemplating plans for slowing down its asset purchase program may trigger similar bouts of market panic.

This article was written by Kennedy Chinyamutangira, Nelly Montoya and originally appeared on Sep 07, 2021.

2022 RSM US LLP. All rights reserved.

https://rsmus.com/insights/economics/boom-times-in-private-equity.html

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each are separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/aboutus for more information regarding RSM US LLP and RSM International. The RSM(tm) brandmark is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

At Keegan Linscott & Associates, our people are our greatest asset. We embody a commitment to our people in our culture of openness, cooperation, teamwork and community service. Keegan Linscott provides exceptional training, coaching, a positive work/life balance and opportunities for personal and professional development. Keegan Linscott’s dedicated team of multi-faceted professionals stand ready to provide the highest quality of audit, tax and consulting services to our valued clients and community. We are leaders in our practice areas and are uniquely qualified to provide innovative and practical solutions.

As a group of practitioners working together, the professionals at Keegan Linscott are able to specialize in specific areas of accounting, audit, taxation, and consulting – a key advantage which allows us to offer a higher standard of service quality.

For more information on how Keegan Linscott & Associates, PC can assist you, please call (520) 884-0176.