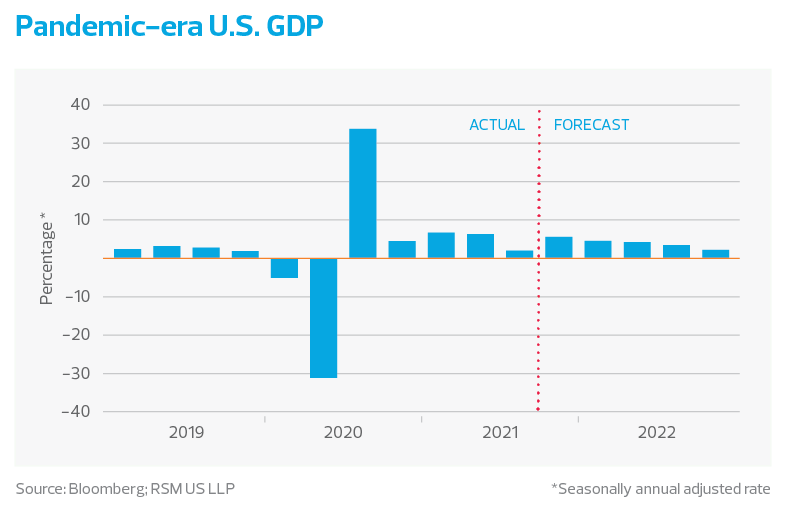

Nearly two years into the pandemic, there are signs that the worst of a once-in-a-century shock to the global economy is beginning to fade.

As the economy approaches a full reopening, we expect that growth in 2022 will exceed 4%, the unemployment rate will fall to 3.5% and job growth will average roughly 230,000 per month.

All of this will happen as inflation slowly recedes from what we think will be a peak near 7% in 2021 to roughly 3% at the end of 2022, setting the stage for tighter monetary policy and a path back toward 2.5% growth in 2023.

While there is likely a wide range of possible outcomes linked to the omicron variant, we do not see a need to alter our growth forecast of 7.2% in the fourth quarter nor the rate for 2022.

The current risk matrix related to growth, employment, interest rates and monetary policy will not alter our expectation that the Federal Reserve will increase the pace of its tapering operations to $30 billion per month, from $15 billion, at its December meeting.

Other major wildcards in the forecast remain the direction of fiscal policy and the fate of the Biden administration’s proposed Build Back Better social spending program, which was still being negotiated in November.

Accommodative monetary policy and robust fiscal support, which blunted the downturn and continue to bolster growth, are likely to fade in 2022.

The current bout of inflation around the world poses another major risk to growth, and central banks are setting the stage to end their support in 2022. We expect that the nexus around growth, employment, inflation and policy will revolve around central bank policy actions in 2022.

Let us be clear: We do not think this is a time to become complacent about the pandemic, vaccinations, boosters and public health risks linked to COVID-19. Rather, we think the economy is transitioning from being at the mercy of a pandemic to one that is learning to live with an endemic—a disease that remains but can be managed. This next phase does not represent an outsized risk to overall economic activity. Should we be wrong on the evolution of the virus, it would result in a slower and more uneven pace of growth next year.

We think next year will be one of transition toward a hypercompetitive economy that features tighter monetary policy and improving capital expenditures that will support rising productivity and a transformation of the American workforce to one characterized by higher wages, flexibility and the rise of millennials into management.

Base case and the U.S. economy

Our fundamental base case is that the American economy will expand near 4.2% on the year with risks of a slower pace of growth if shocks to the global supply chain persist and inflation proves stickier with rising rents pushing up costs.

These risks to what is an otherwise optimistic outlook could be compounded if the Federal Reserve misses the mark on the pace of its tapering operations and the start of the inevitable rate-hike campaign that we anticipate will take place December 2022.

Growth will be fueled by the release of pent-up demand among households, which are flush with more than $2.5 trillion in excess cash, and by fixed business investment, which continues to soar late into the pandemic. Unless the Build Back Better proposal is passed and signed into law, the fiscal support that propped up the economy during the pandemic will continue to fade.

We expect that tighter monetary policy and fading fiscal boost will result in growth decelerating to 2.5% in 2023.

One of the more interesting aspects of government transfers, wage subsidies and other policies aimed at supporting households during the pandemic is the change in the composition of household savings.

According to Bloomberg Economics, roughly three-quarters of the close to $2.6 trillion in excess savings built up during the pandemic are concentrated in households other than the top income quintile—a striking change from past business cycles.

That implies the median household has sufficient cash to absorb higher prices—however sour that might be—and it will support a pace of household consumption near 3.5% in 2022 with upside risk, should inflation fade faster than we anticipate.

Finally, private investment should moderate from what we expect will be a torrid 8% pace in 2021 to a still hot 4.2% in 2022. Not only will productivity-enhancing fixed business investment continue to soar, but we expect that demand for housing will exceed 1.6 million at an annualized pace during the year.

Inflation: A major risk

While most economists expected inflation to climb well above target because of base-year effects, or comparisons to the low levels of a year ago, in energy, transportation and lodging, few predicted a move well above 6% in the consumer price index and near 4% in the Fed’s core policy variable.

Yet that is exactly what has happened, resulting in inflation becoming the major risk—outside of a resurgence in the pandemic—to the economic outlook for the first time in three decades. And this is why U.S. central bankers may accelerate the pace of tapering operations and pull the first rate hike into the latter part of 2022.

Rising inflation has primarily been the result of stressed supply chains and surging consumer demand, and not because of rising wages.

Roughly 62% of the factors driving inflation higher is clustered in about 30% of the consumer price index. The idea that much of what is driving inflation will ease in early 2022, especially during the March to June period, remains our core base case.

We see the top-line CPI easing back toward 3% near the end of the year and the central bank’s policy variable ending the year at 2.5%, both with risk of more elevated rates of inflation.

The first half of the year will almost certainly feature stubborn inflation, and its decline will depend on the evolution of the pandemic, the return to work of the labor force around the world and an easing of supply chain bottlenecks. But a tightening labor market may result in a pivot in rising wages, driving up business costs and prices. This dynamic is why we anticipate the Fed’s policy variable, the year-over-year core personal consumption expenditures price index, will increase by 2.5% in 2022.

While we are growing more optimistic about improved industrial production in the North American economic bloc in general and in automobile production in particular, it is premature to call a bottom in the global supply chain crisis or to ignore top-line inflation data. Stress is still quite evident inside our proprietary RSM US Supply Chain Index.

Labor: A return to full employment

The U.S. economy is experiencing something of a revolution in the workplace accelerated by the pandemic. A broad array of demands by labor, including higher wages and more flexibility, has resulted in the transformation of the American workforce. We expect those changes to accelerate in 2022 amid a tight labor market and a return to full employment.

Even after months of recovery, the domestic labor market in November was short roughly 4.6 million workers compared to pre-pandemic levels. Through the first 10 months of the year, the economy generated roughly 5.81 million jobs or an average of 582,000 per month. We expect that torrid pace to slow to a much more sustainable 230,000 per month or roughly 2.76 million on the year.

That suggests that the 4.6% unemployment rate in October will fall to near 3.5% by the end of 2022. But the risk of the economy running hot accompanied by rising wages will weigh heavily on policymakers at the Fed in 2022.

The Fed and fiscal policy

The major policy shift of 2022 will be the Fed’s withdrawal of monetary accommodations during the first half of the year and then what we expect will be a rate hike campaign starting in June with the chance of a quicker start in March.

We expect the policy rate to float between 50 and 75 basis points at the end of 2022 with the possibility of a slightly higher rate should the Fed turn hawkish in the face of stubborn inflation. Under our alternative scenario, the Fed would hike rates three times in 2022, lifting the policy rate to a range of 75 basis points and 1%.

Given the fact that we think inflation may peak near 7% this year, the Fed may choose to accelerate the pace of its tapering operations, which in November was set at $15 billion per month, with a target of March 2022 to wrap up operations. We expect this to be announced at the Fed’s December meeting.

The year ahead will mark an unusual event: The Fed hikes rates before the midterm elections in November and it may map out alternatives like changing its balance sheet policy—letting the balance sheet begin to naturally decline— which would certainly dampen inflation expectations.

Fiscal policy and our economic outlook for 2022 are inextricably linked to the Biden administration’s Build Back Better social spending plan. We do not assume that this legislation will become law, but if it does in the closing days of 2021 or early 2022, then we will have to upgrade our growth forecast and adjust our rate expectations.

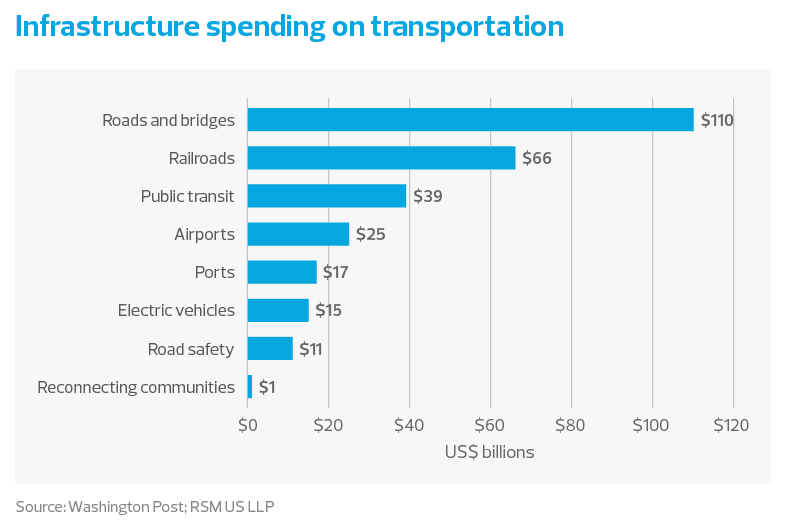

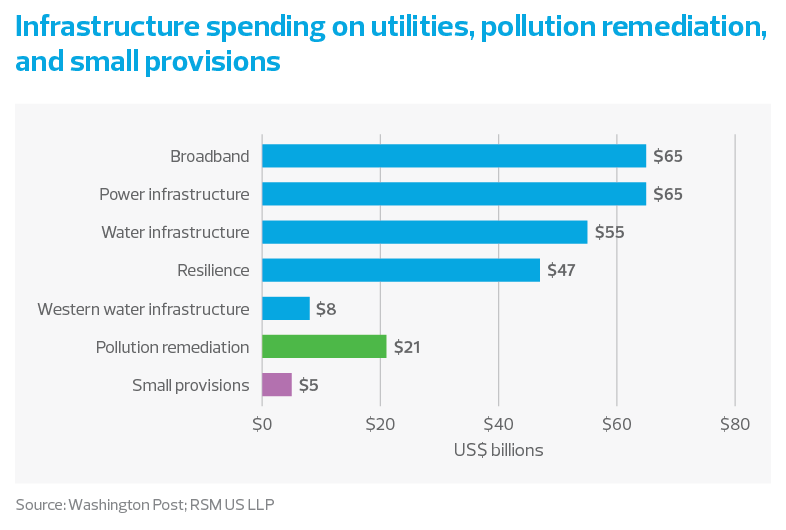

For now, the only real fiscal boost that the economy will receive in 2022 will be through the $1.2 trillion infrastructure package. That initiative, though, is not front-loaded with spending with only about $16 billion coming in 2022.

But the design of the legislation, which was crafted to support an increase in productivity and growth, will likely do exactly that over the decadelong window in which it will be in effect.

Academic work conducted over the past three decades implies that for each 10% increase in infrastructure investment, national output grew by 0.8% in the near term and by 1.2% over the long term, with almost all of that growth occurring through the productivity channel.

Similar scholarly work implies that a 1% increase in public capital investment in hard infrastructure results in a 0.24% increase in productivity. With real yields still negative, once one accounts for state and local government-sponsored infrastructure investment, the economy should experience roughly $2.2 trillion in total infrastructure investment over the next decade.

We think there is the possibility of improved growth and productivity compared to baseline studies that occurred during a very different economic and rate environment.

U.S. rate outlook

We expect that the yield on the 10-year U.S. government security will finish 2021 near 1.8% and is likely to arrive at 2.25% at the close of 2022.

The increase in long-term rates, while low by historical standards and negative on an inflation-adjusted basis, will rise because of the shift in monetary policy and robust economic growth in 2022.

A look at market-based forwards in a year implies a modestly steeper yield curve with the front end anchored by the federal funds rate at or between 0.25 and 0.50 basis points, with the 10-year yield sitting at 1.84%. Our expectation of a 2.25% rate to end 2022 is somewhat bearish for bonds and bullish on the economy.

Given that we do not anticipate the Fed’s core policy variable, the personal consumption expenditures deflator, to return to the Fed’s 2% inflation target until 2023, we think that forward markets are moderately mispriced given the risks around inflation.

Currently, the RSM US Financial Conditions Index stands more than one standard deviation above neutral, which implies that sentiment remains skewed toward risk assets as bond prices fall and yields rise.

The takeaway

The American economy next year will be a story of transition: from an economy adapting to the shock of the pandemic to one characterized by tighter monetary policy, less fiscal support, robust growth and a hyper-competitive landscape for businesses.

This article was written by Joe Brusuelas and originally appeared on 2020-12-08.

2022 RSM US LLP. All rights reserved.

https://rsmus.com/insights/economics/Looking-ahead-2022-economy.html

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each are separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/aboutus for more information regarding RSM US LLP and RSM International. The RSM(tm) brandmark is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

At Keegan Linscott & Associates, our people are our greatest asset. We embody a commitment to our people in our culture of openness, cooperation, teamwork and community service. Keegan Linscott provides exceptional training, coaching, a positive work/life balance and opportunities for personal and professional development. Keegan Linscott’s dedicated team of multi-faceted professionals stand ready to provide the highest quality of audit, tax and consulting services to our valued clients and community. We are leaders in our practice areas and are uniquely qualified to provide innovative and practical solutions.

As a group of practitioners working together, the professionals at Keegan Linscott are able to specialize in specific areas of accounting, audit, taxation, and consulting – a key advantage which allows us to offer a higher standard of service quality.

For more information on how Keegan Linscott & Associates, PC can assist you, please call (520) 884-0176.