March 21, 2024

Biden administration's budget proposal includes items affecting donor advised funds and private foundations.

March 19, 2024

In 2023, Christopher Linscott, CFE, CPA, CIRA, arranged a donation of $250,000 to the ACFE Foundation — the single largest donation to the foundation ever. ...Read More

March 14, 2024

Federal government contractors need to prepare the incurred cost submission (ICS). Learn best practices for preparing this important document.

March 11, 2024

Government contractors will face challenges and opportunities because of the 2024 National Defense Authorization Act (NDAA).

February 28, 2024

The December 2023 revision of Form 8283 includes new reporting for digital assets, certified historic structures and passthrough entity information.

February 21, 2024

We highlight five key tax considerations for industrial merger and acquisition deals.

February 15, 2024

The evolving retirement plan landscape opens opportunities for companies to review employee compensation packages and consider changes to their plans.

February 2, 2024

Explore how global banks can improve their ESG reporting and meet existing and proposed regulations in Asia, the EU, California and the U.S.

February 1, 2024

Tax legislation packaging the child tax credit and favorable business tax provisions moves to the Senate with momentum but an uncertain fate.

January 24, 2024

New electronic filing requirements, revised form 1099-NEC and new form 15397 present addional challenges for 1099 filers that may necessitate updates

January 16, 2024

Notice 2024-11 updates the list of U.S. income tax treaties that meet the requirements of section 1(h)(11)(C)(i)(II).

January 12, 2024

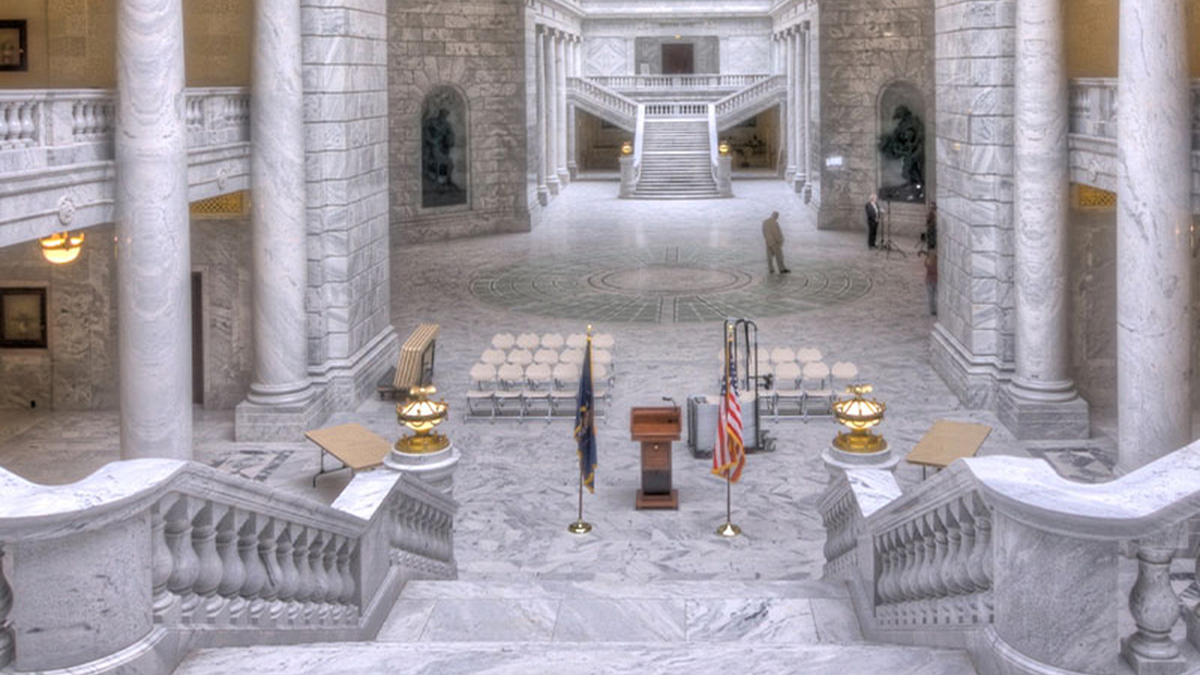

Highlights and need-to-know policy landscape as the 2024 state legislative sessions begin.

News & Insightsjvista2022-06-13T10:13:50-07:00