Although Americans’ charitable giving declined in 2022, the long-term trend shows that larger gifts and higher-income donors have buoyed overall giving. Smaller donations and gifts from lower-income donors have consistently dropped. This is why analyzing the giving trends of more affluent donors is critical for nonprofits.

Bank of America and the Indiana University Lilly Family School of Philanthropy recently released an important study on the charitable giving of affluent households. The analysis focuses on 2022 data, but nonprofits can study trends that will affect philanthropic giving in the future. Here are three critical observations.

Younger donors have different preferences

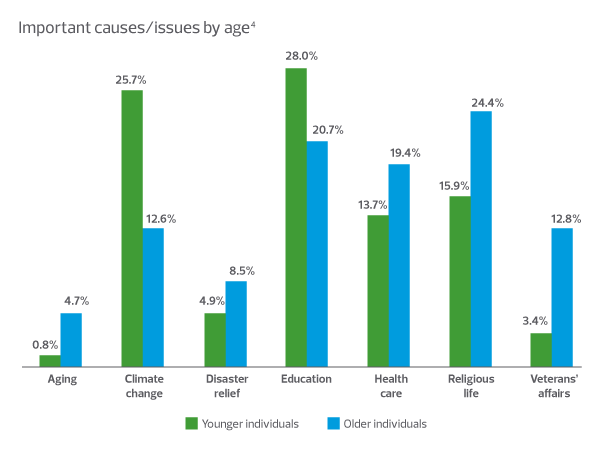

Many nonprofits have long-established relationships with loyal and reliable donors. While this remains a source of strength in philanthropy, a shift is rapidly taking place. The proportion of those in younger generations making donations is rising, while the percentage of givers who are older and retired is falling. But younger generations’ giving preferences are notably different. The report shows a significant increase in the support of climate change and education, with a significant decrease in veterans’ affairs and religious life.

Nonprofits need to understand their current donor base, but they also need to acknowledge their pipeline decades into the future. Building connections and loyalty with donors by aligning their interests with a nonprofit’s mission is more important than ever.

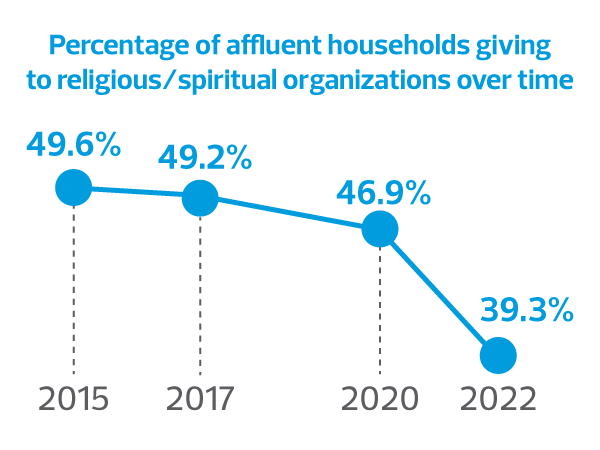

Affluent households are giving less to religious organizations

Overall donor data has shown a marked reduction in giving to religious organizations. The Bank of America/Lilly report goes one step further to show that affluent households are leading this trend, with only 39% of households giving to religious institutions, which is a historic low.

Religious organizations need to adapt to this new normal. Many long-standing institutions have relied on older, faithful donors. However, the data show that this approach is not likely to hold up, and the sooner these institutions adjust to new giving levels, the more likely they will be to continue operations without significant financial hardships.

Donors care about aligning mission and values more than anything else

Affluent donors are clear about why they give to nonprofits: because their own values and beliefs are aligned with the cause of the organizations. The study found that the top-ranked reason for giving was “personal values or beliefs,” which almost 70% of affluent donors listed.

Source: RSM US LLP.

Reprinted with permission from RSM US LLP.

© 2024 RSM US LLP. All rights reserved. https://rsmus.com/insights/industries/nonprofit/nonprofits-need-to-study-affluent-donors-and-giving-trends.html

RSM US LLP is a limited liability partnership and the U.S. member firm of RSM International, a global network of independent assurance, tax and consulting firms. The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmus.com/about for more information regarding RSM US LLP and RSM International.

At Keegan Linscott & Associates, our people are our greatest asset. We embody a commitment to our people in our culture of openness, cooperation, teamwork and community service. Keegan Linscott provides exceptional training, coaching, a positive work/life balance and opportunities for personal and professional development. Keegan Linscott’s dedicated team of multi-faceted professionals stand ready to provide the highest quality of audit, tax and consulting services to our valued clients and community. We are leaders in our practice areas and are uniquely qualified to provide innovative and practical solutions.

As a group of practitioners working together, the professionals at Keegan Linscott are able to specialize in specific areas of accounting, audit, taxation, and consulting – a key advantage which allows us to offer a higher standard of service quality.

For more information on how Keegan Linscott & Associates, PC can assist you, please call (520) 884-0176.